ANALYSIS:

Why is Greater Paris a great fit for student housing

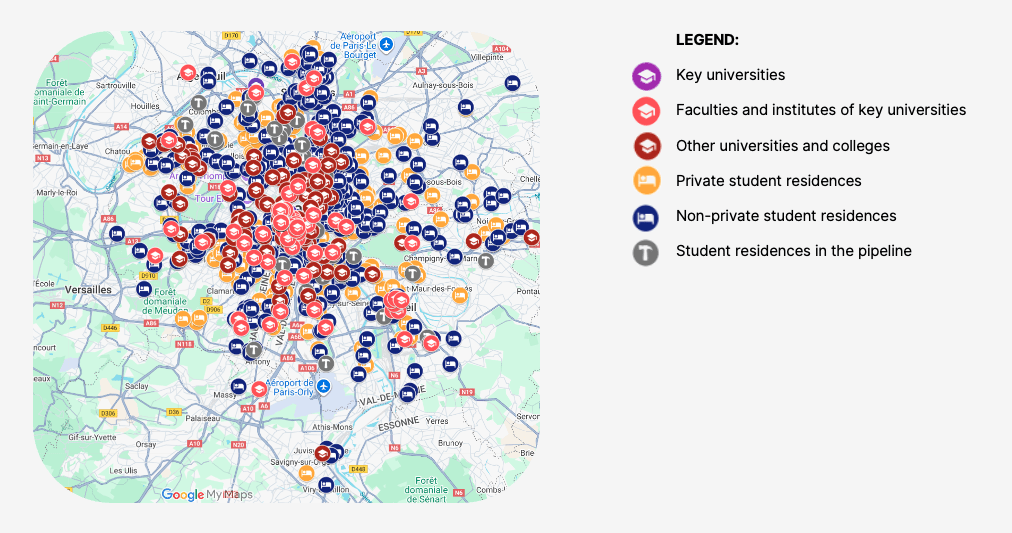

Greater Paris stands as France’s principal higher-education hub and one of Europe’s largest and most globally connected student metropolitan areas. The student population currently exceeds 491,600, of which 82% are mobile students likely to require dedicated student accommodation (including 81,000 international students).

If you are short on time:

With almost 500k students, Greater Paris is the second largest edu hub in Europe;

Demand has consistently outpaced supply development and 250k beds are missing;

Location key factor to new asset development.

Stable increase in demand is forecast

Demand in the sector is expected to remain robust, supported by continued growth in international enrollment and sustained national investment in higher education, with the Greater Paris area benefiting from its dense concentration of globally ranked institutions and strong labour market.

Demand

2024/25

2029/30 (f)

5Y CAGR (f)

Total students

491,613

514,155

+0.9%

Domestic

410,508

426,401

+0.8%

International

81,105

87,754

+1.6%

Newly-deployed assets achieve greater bed capacity

Currently, Greater Paris has 670 student residences with a total capacity of over 88,520 beds, of which 36% are in private PBSA. The average capacity of private student residences in the city is 169 beds, highlighting the generally larger scale of privately operated student residences compared to those in the non-private segment. The majority of private PBSA properties offer between 100 and 299 beds.

Residences delivered by major PBSA operators over the past 5 years have been even larger, averaging 233 beds, although capacities vary widely. The current net PBSA provision rate in Greater Paris is 21.9% compared to a saturation ceiling rate of 73%, reflecting an estimated shortfall of over 206,700 beds.

Supply

Assets

Beds

Private

193

31,965

Non-private

477

56,556

Total

670

88,521

Pipeline is active, but will not solve the shortage of beds

36 new PBSA residences with a planned total capacity of nearly 8,000 beds are currently in the development pipeline or under renovation across Greater Paris. This includes 23 projects (6,002 beds) under construction for delivery by 2028 and five projects (1,005 beds) in planning, with additional schemes lacking confirmed opening timelines.

Based on pipeline PBSA projects under construction and/or with publicly disclosed delivery timelines by the end of 2029, total PBSA stock is expected to increase to 96,145 beds.

What does this mean for stakeholders?

The PBSA market in Greater Paris is forecast to face a shortfall of around 214,950 beds by 2029, corresponding to a net provision rate of 22.6%, underscoring significant development and investment opportunities in the sector.

The impact of this shift extends well beyond the classroom, affecting real estate and student housing investors, governments, and education providers.

CONTACT FORM

Find out how we can cater to your specific needs

We look forward to assisting you further and explaining how our services can benefit you.

First name*

Last name*

Email*

What type of organisation do you represent?*

What type of organisation do you represent?*Education ProviderEducation AgencyGovernmentAssociation/Study ClusterMediaService ProviderOther

Your message*