PRESS RELEASE

Student Housing Investors Grow More Confident About 2026

Confidence among investors strengthened ahead of 2026, with a clear majority signalling plans to increase exposure to student housing

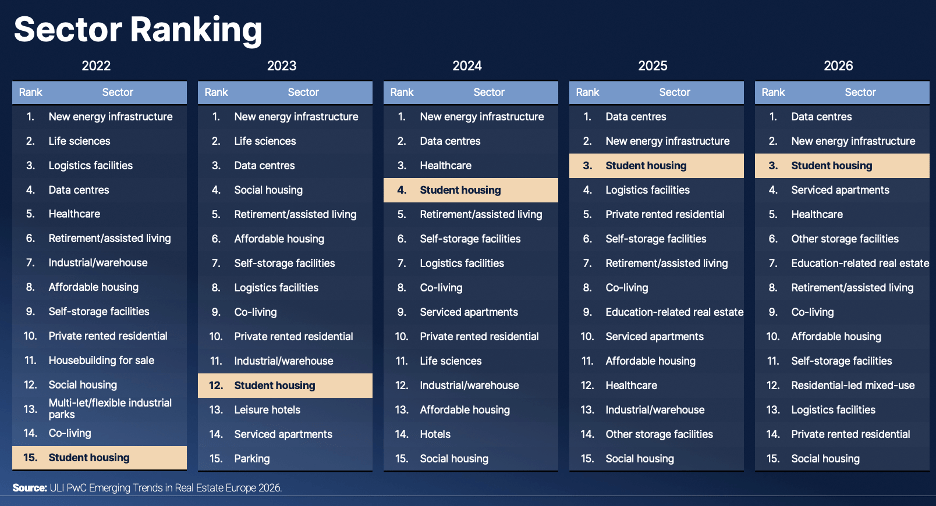

Vienna, 28 January 2026 - Student housing continues to strengthen its position as an important institutional real estate asset class, with investor confidence rising ahead of 2026, according to insights shared during BONARD’s Student Housing Annual Report 2025 presentation and industry discussion.

The session attracted over 1,500 registered participants. Live polling during the session highlighted strengthening sentiment, with 78% of respondents signalling plans to increase their exposure to student housing in 2026.

“Student housing remains one of the most compelling real estate asset classes, and for many investors it is increasingly the first allocation beyond traditional sectors,” said Samuel Vetrak, CEO of BONARD. “The poll results clearly show growing confidence going into 2026.”

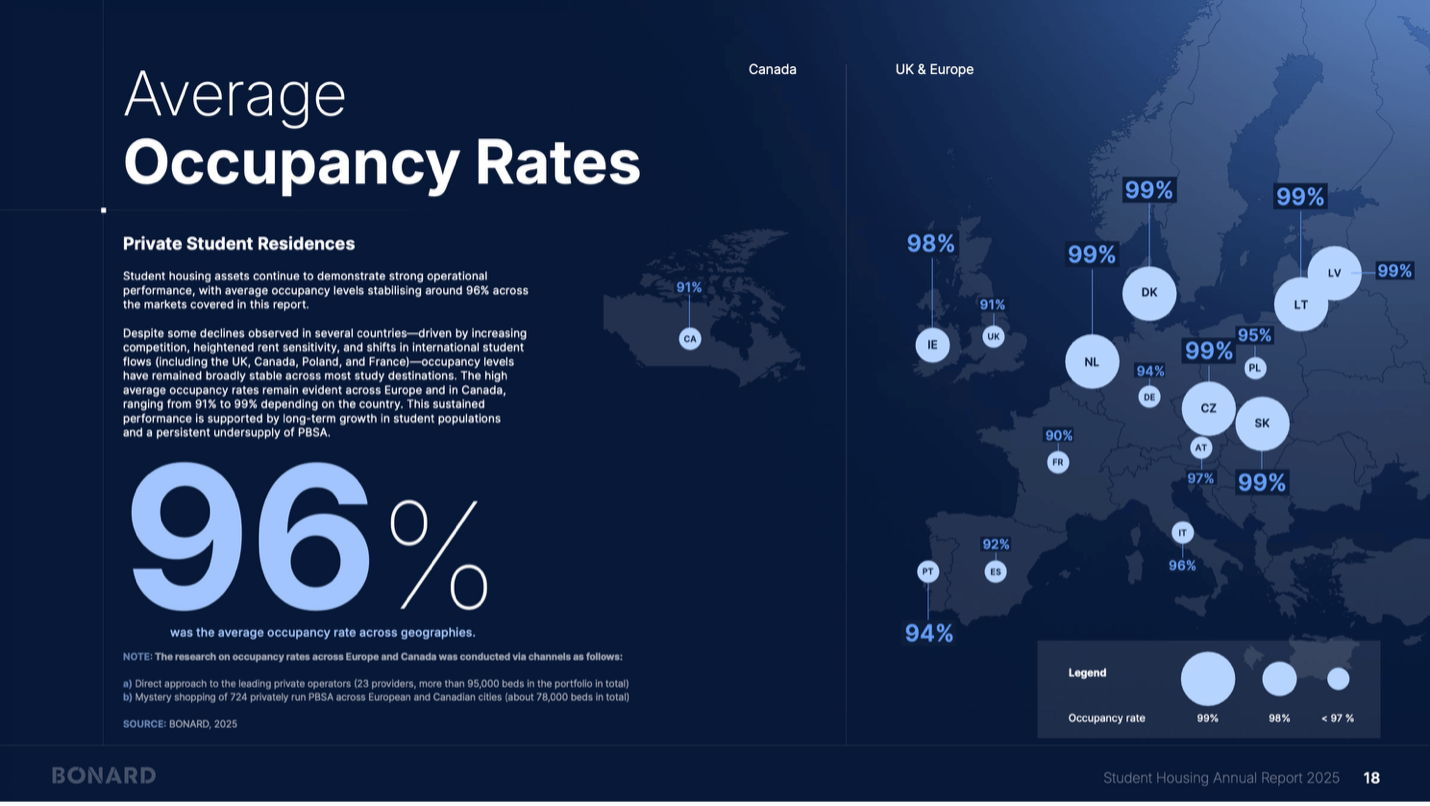

After several years of elevated growth, rental performance is normalising but remains resilient. Average student housing rent growth reached 3.1% in 2025, down from 5.4% in 2024. In continental Europe, rent growth remained close to 4%, still above inflation, reinforcing student housing’s role as a defensive, income-resilient asset class. In more mature markets, increasing student housing supply is also beginning to moderate rent pressure in the wider residential sector.

Studios remain the dominant product type across Europe, accounting for the majority of new supply, although average unit sizes are gradually decreasing as affordability, regulation and urban constraints shape more compact layouts.

Live polling confirmed these trends, with 83% of respondents expecting rents to increase by September 2026 – primarily within a 0–3% (just over half) or 3–7% (around one-third) range - pointing to continued income growth at sustainable levels.

Operational strength and market knowledge increasingly decisive

Senior executives from Brookfield, Nido Living (owned by CPPIB) and Rockfield Real Estate shared perspectives on market conditions, collectively representing some of the most active participants in European student housing transactions in 2025. While yields have remained broadly stable – with early signs of compression in select markets – speakers agreed that operational capability, local market knowledge and platform scale are becoming increasingly important differentiators.

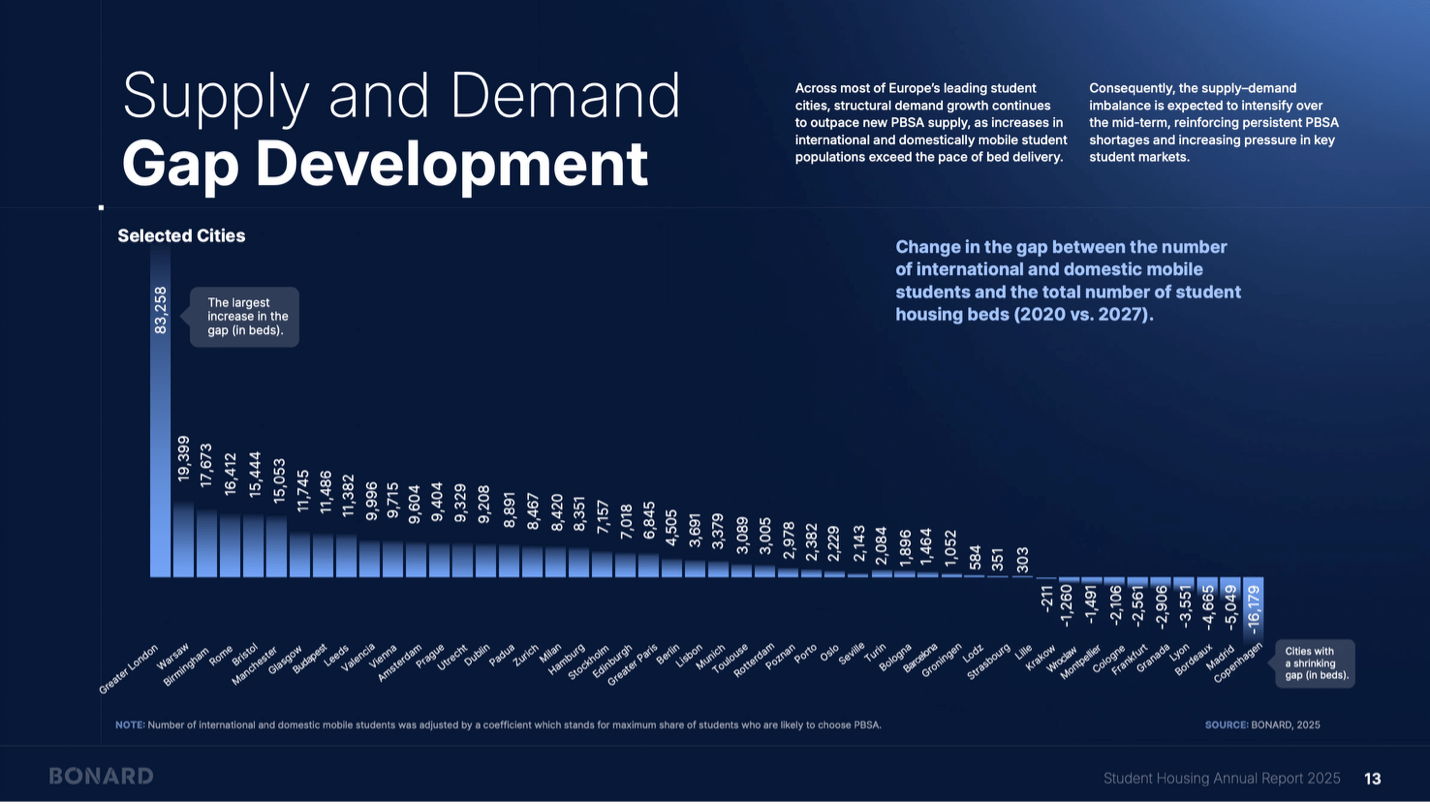

Pedro Sousa of Brookfield pointed to the sector’s enduring fundamentals, stating that “student housing continues to benefit from a structural demand–supply imbalance, particularly across European markets where development remains constrained.”

Juan Manuel Acosta of Rockfield Real Estate highlighted the sector’s growing maturity, noting that “as institutional capital scales across Europe, credibility and execution certainty are becoming increasingly critical to successful transactions.”

Carlo Matta of Nido Living added that “across continental Europe, student housing fundamentals remain compelling, with demand continuing to outpace supply. Deep understanding of the local market and drivers are key to sustainable growth.”

Transaction activity reinforces confidence

Transaction volumes across the UK and continental Europe reached €10.5 billion in 2025, representing a 75% increase year-on-year. The UK accounted for nearly €6 billion of total activity, while continental Europe recorded strong pricing momentum, reinforcing investor conviction ahead of 2026.

Taken together – market data, transaction activity, expert insights, live audience polling and BONARD’s ongoing dialogue with institutional investors – the signals point in the same direction: student housing is emerging as one of the strongest candidates for increased real estate investment allocation in the years ahead.

Data-driven decision-making gains importance

As the sector matures and competition intensifies, BONARD noted rising demand for professional sector data, enabling more granular underwriting and portfolio optimisation in a flatter yield environment.

“Student housing is no longer a niche sector,” Vetrak added. “It is a mainstream asset class where data, execution and long-term strategy increasingly determine success.”

For more details, you can now request BONARD’s Student Housing Annual Report 2025 at the following link: www.bonard.com/2025

Media contact

Stefan Kolibar

Chief Partnerships Officer

BONARD

About BONARD

BONARD is a global data and intelligence provider specialising in student housing and rented residential real estate. The company supports investors, lenders, developers and operators with asset-level market data, benchmarking and research across Europe, North America and other key living-sector markets. BONARD’s insights are widely used for underwriting, portfolio optimisation and strategic allocation decisions across institutional real estate.

Photos that can be used:

CONTACT FORM

Contact us

Do you have questions about the Student Housing Annual Report 2025? Please fill out this form, and a member of our team will get back to you shortly.

⠀

⠀⠀⠀