The latest BONARD Student Housing Annual Report shows a PBSA sector stronger than ever despite the challenges of the last quarter of 2022. The PBSA sector has registered another strong year with occupancy rates and rents rising, according to the newly released BONARD Student Housing Annual Report.

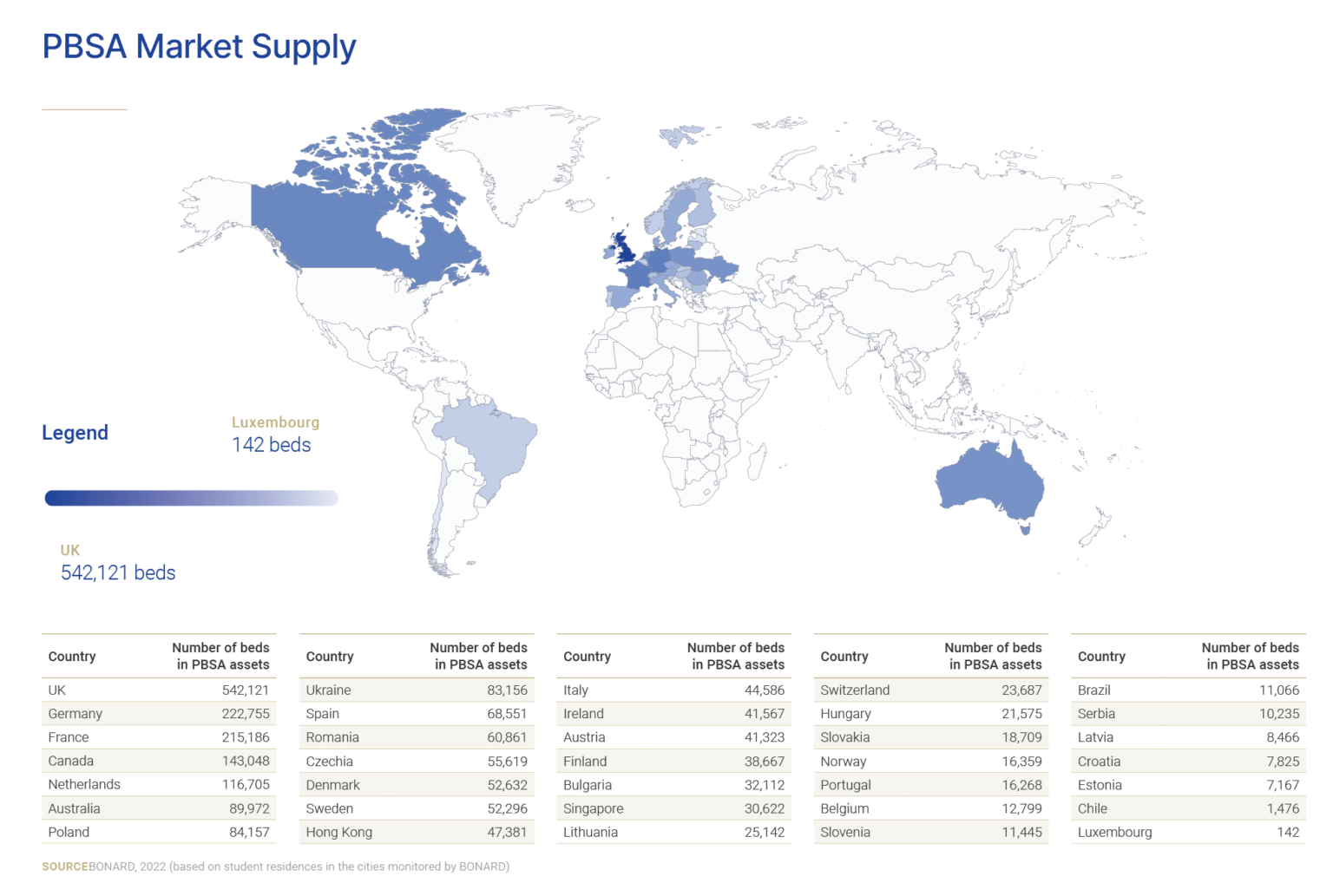

Prepared by BONARD’s team of experts on student housing, the report’s latest edition tracks occupancy rates, rent levels, transactions, yields, construction pipelines and other key data points in the market across Europe, Australia, Canada and LATAM. The new topics added in this year’s edition include room size comparison to rent levels, rent series, and portfolio structure.

While soaring inflation, interest rates and rising costs in the last quarter of 2022 have slowed down investment transactions, the overall outlook is positive and experts expect the sector to keep growing in the next two years. Growth will be driven by increased demand, especially from international students – and in some locations, supply will actually struggle to keep up with demand.

According to the report, occupancy rates hovered between 95 to 99 percent in Europe, while the average rent for a studio has reached €946 a month. Porto, Barcelona and Seville top the charts for the biggest construction pipeline, while Greater London and Greater Paris have the highest number of projects under construction.

BONARD CEO Samuel Vetrak said: “The PBSA sector was affected in 2022 by the macroeconomic conditions, but less so than other asset classes. In 2023, we can see even greater institutional capital demand this asset class. Q4 2022 was a transition and adaptation quarter. Still, occupancy is high and rents are growing – in some countries 20 percent or 30 percent more than the year before. On the other hand, interest rates are expected to keep increasing slightly in 2023. And while development costs have stabilised, what has not changed is the cost of land. Some investors are waiting for a correction on that front.”

The report was presented by Martin Varga, Real Estate Business Development Director at BONARD. The webinar welcomed over 1,000 participants from around the world. The presentation was followed by a panel of industry experts chaired by Vetrak. Josh Miller, Managing Director, Head of Transactions – Europe at Harrison Street, Rob Waterhouse, Transaction Director at GSA, Marc Sampietro, Living Operations Director at aparto and Jochem van den Broek, Head of Banking at The Social Hub, joined the panel.

Here are some of the insights from the webinar presentation and audience polls.

A positive outlook

Strong increases in international student numbers are driving demand in several countries, keeping occupancy rates high and fuelling optimism in the sector. Asked to indicate the occupancy rates they observed in autumn 2022 in an audience poll, 56 percent of the webinar participants voting in the poll reported occupancy rates between 96 and 100 percent, and 24 percent said they were between 91 and 95 percent.

The panellists confirmed the data. Miller said: “From a transaction perspective…the second half of the year certainly had its challenges…I think across the institutional investor community the bar has been raised in terms of the threshold that’s needed to get deals done. I think that’s likely to continue for some time. But from an occupancy and rent perspective… it’s been one of our best years since we have been in business. The performance of this sector relative to most of the other real estate asset classes has been a bright spot.”

Other panellists also agreed that occupancy rates are expected to remain high and keep rising and pointed to China’s decision to require students to study abroad rather than online from 2023 as “good news for the sector.”

The outlook is positive also for transactions and yields.

An audience poll quickly revealed that participants expect exit yields to expand in 2023, with 42 percent of respondents saying they will expand by up to 50 bps. The panellists confirmed this view, adding that the picture will vary across individual countries.

As for investment trends, Europe and specifically Southern Europe are high on the priority list for all panellists.

Demand outstripping supply

Vetrak commented: “Supply is not growing as fast as demand, that’s probably the story for 2023-24.” According to BONARD research, the project completion pipeline could potentially slow down in 2024. In the period between 2018 and 2021, an average of approximately 50,000 new beds per year were delivered globally (excluding the US). In 2022 delivery sped up to 75,000 and 77,000 beds are in the pipeline for 2023. However, so far data shows that only about 38,000 beds are expected to be delivered in 2024.

Miller commented that rising building and financing costs, and planning difficulties in some markets, have made launching developments more challenging. He said: “The supply and demand imbalance is probably going to continue to be exacerbated over the next couple of academic years.” However, he added, he expects that with inflation and financing costs hopefully plateauing, new opportunities could be unlocked at some point over the course of 2023.

Focusing on quality

One of the most successful features of the PBSA sector is its flexibility to adapt to unfavourable economic conditions. Rents have been rising sharply, with 3 percent in Europe on average (in Czechia as high as 37 percent) and 8 percent in Australia and Canada, and this has helped to offset increasing utility costs.

And while rent hikes haven’t dampened demand, the sector needs to focus on quality to meet students’ expectations, the panellists commented, ensuring that amenities and services match what students are looking for.

Sampietro said: “If you increase rents, you also increase expectations. That’s why it’s important to offer a package of services… students will ask for more. That’s our key message when we are talking about rents: what other services are we going to include?”

Van den Broek agreed: “Especially for international students… if you go abroad, you want it to be the time of your life… So, rent increases, yes. But value for money is key.”

Rents are expected to keep rising in 2023. An audience poll confirmed this prediction, with 53 percent of respondents saying they expect rents to increase by more than 4 percent.