Rent prices: The Student Housing Annual Report 2022 by market research company Bonard, based on an analysis of 13,676 PBSA assets, found that monthly rent for a single studio in a private PBSA rose by an average of 8.0 per cent in Canada last year (to €1,032), and by 7.9 per cent in Australia (to €1,120).

Increases were more modest in the UK (4.4 per cent to €1,141) and Continental Europe (3.1 to €664), although the Czech Republic (36.5) and Poland (26.7) had the highest year-on-year increases.

The authors said that due to the strong demand from students, operators could afford to push rents up to cover at least some of the inflationary costs without loss in occupancy, and also noted that current-year students may see further increases.

Rent changes between 2021 and 2022. Graphic source - Bonard.

Rent changes between 2021 and 2022. Graphic source - Bonard.

Rent per sqm: Looking at price per square meter, the authors found that Tier 1 cities (those with more than 100,000 university students) charged an average rent of €42.5 per sqm, compared with €31.5 for Tier 2 cities (with 50,000 to 100,000 students).

By individual city, Australia had the highest square-metre rent charge at more than €60, while Romania, Brazil, Chile and Hungary were below €20. Denmark offers the largest average room size for a single studio at 36 sqm, followed by Canada, Italy and Belgium.

Residences built in the last three years charge a higher average rent per sqm (€39.2) compared with those built before (€35.7), the authors said.

Occupancy of PBSA: Occupancy rates were at an average of 98 per cent in 2022 in the UK, Europe and Canada, marking a recovery for those that had dropped below 90 per cent due to Covid restrictions in the previous years.

PBSA stock: Among the markets analysed, the UK had comfortably the largest stock of PBSA beds at 542,121, followed by Germany (222,755), France (215,186), Canada (143,048) and the Netherlands (116,705).

From analysis of market saturation, the authors said that Madrid and Rome have the most lucrative investment opportunities, as both need more than 50,000 beds to reach a 25 per cent PBSA bed-to-student ratio, and that Sao Paolo and Sydney have even greater need for additional student accommodation.

New beds in 2022: Across Europe, there were 61,090 new PBSA beds delivered in 2022. Porto had the most new PBSA beds in 2022 (4,164 at eight properties), followed by Barcelona (3,271 at 10 residences), London (3,029), Seville (2,844) and Coventry (1,969).

Pipeline of new beds: At the time of writing the report, there were 961 projects in the pipeline across Europe, and 35 per cent of the planned beds are under construction and due to deliver an additional 94,000 beds to the sector. Greater Paris currently has the most beds in the pipeline at 17,773, followed by Greater London (14,816), Nottingham (7,825), Berlin 7,085) and Dublin (6,806).

Amenities at PBSA: In the report, the authors also analysed changes to amenities, comparing PBSA that has opened in the last three years compared with older stock. They found that bicycle storage, gyms, games rooms and study rooms were becoming increasingly prevalent. During a webinar presentation of the report, Jochem van den Broek of The Social Hub predicted that there will be more focus on experience, lifestyle and community at PBSA will be key in the years ahead.

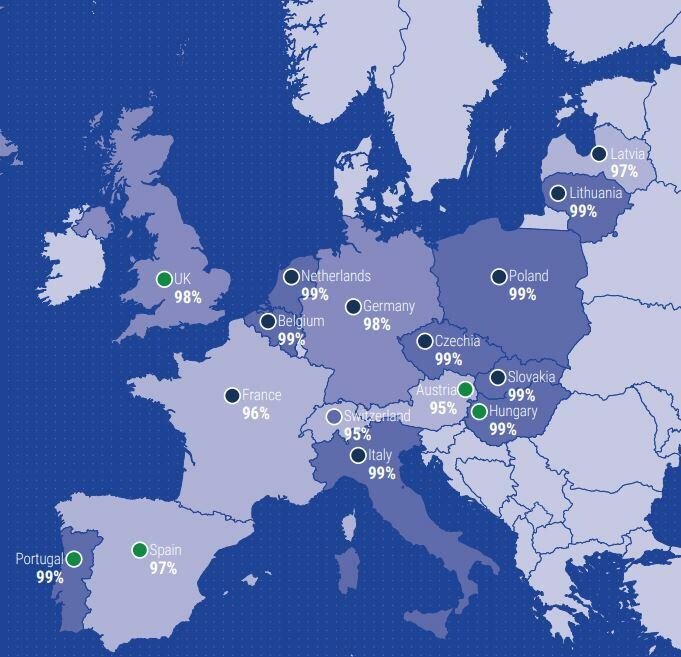

Occupancy rates in private PBSA across Europe in 2022. (Green denotes increase). Source - Bonard.

Occupancy rates in private PBSA across Europe in 2022. (Green denotes increase). Source - Bonard.

PBSA transactions: The value of transactions in the UK and Europe reached €12.4 billion in 2022, more than in any of the previous three years including the pre-pandemic 2019 (€7.8 billion).

The 2022 total was comprised of €7.7b billion in the UK, where major deals including the acquisition of Student Roost by Greystar/GIC; and €4.7 billion in Continental Europe, where major deals including Xior Student Housing NV ’s acquisition of the Basecamp portfolio, and investment in The Student Hotel, which later rebranded as The Social Hub.

The Social Hub in Barcelona, which opened in 2022.

The Social Hub in Barcelona, which opened in 2022.

In the introduction to the report, Samuel Vetrak, CEO of Bonard, said, “The PBSA asset class has proven itself to be a safe investment with a defensive nature towards any kind of economic crisis. Thanks to the primary demand indicators – rising or stable student numbers over past years – provision rates (defined as student-to-bed ratios) within this asset class have remained attractively low, motivating investors and stakeholders to increase or stabilise their presence within the asset class.”

During a special webinar to introduce the 2022 report, Bonard invited a panel of PBSA representatives to discuss the findings and future trends, including Rob Waterhouse of GSA, Josh Miller of Harrison Street, Marc Sampietro of aparto , and Jochem van den Broek of The Social Hub.

Panellists agreed occupancy numbers and demand were strong and predicted growth in demand for the 2023/24 academic year. However, it was noted that transactions and investments in the sector became more challenging from the fourth quarter of 2022 onwards.

Click here to request a copy of the full report from Bonard.

At the time of writing, €1 = US€1.08

By Matthew Knott

News Editor