The 2022 Student Housing Annual Report from industry research specialists BONARD provides important insights on purpose-built student accommodation (PBSA) stock across 253 markets in Europe, the Americas, Asia, and Australia. In total, those markets are home to 13,676 PBSA facilities, a third of which are managed by private-sector providers, and 2,255,678 beds.

One overarching theme in the report is of continuing strong demand into 2022, as we see reflected in the chart below.

Year-over-year changes in demand for PBSA beds, selected countries, 2020/21 – 2021/22. Source: BONARD

Year-over-year changes in demand for PBSA beds, selected countries, 2020/21 – 2021/22. Source: BONARD

The BONARD analysis also clearly makes the link between that continuing, strong demand and rental rates for PBSA housing, anticipating that in 2023: “Rent changes will reflect inflation to a greater extent. Unless the situation calms, the [2023/24] academic year may face a second wave of this pressure on rent levels. The main aspect of a strategic decision to provide a correction will remain the demand indicator…as a moderate increase in rent levels can be tolerated by the market in general.”

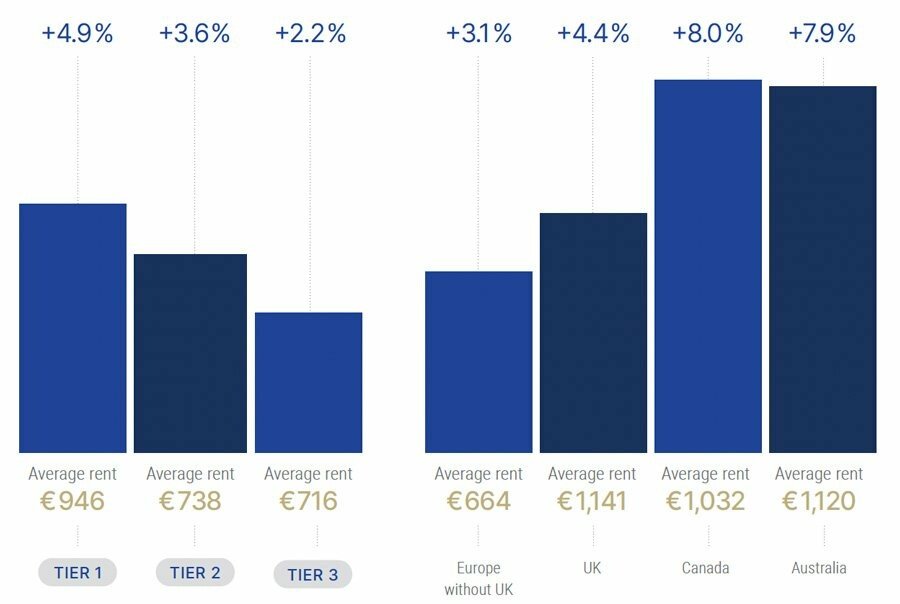

Any such increases, however, will come on top of the upward pressure on housing prices in 2022. Driven as they were by surging inflation rates, year-over-year changes in rental rates, in some markets at least, have already been significant.

2022 vs 2021 change in the average monthly rent for single studio in private PBSAs. Note that rental rates are price per person including utilities and applicable taxes. Tier 1 cities are those with 100,000 students or more; Tier 2: 50,000-100,000 students; Tier 3: Fewer than 50,000 students. Source: BONARD

2022 vs 2021 change in the average monthly rent for single studio in private PBSAs. Note that rental rates are price per person including utilities and applicable taxes. Tier 1 cities are those with 100,000 students or more; Tier 2: 50,000-100,000 students; Tier 3: Fewer than 50,000 students. Source: BONARD

However, the ability and willingness of the student market to accommodate those rental increases is reflected in part in the consistently high occupancy rates for the sector, which continued into 2022.

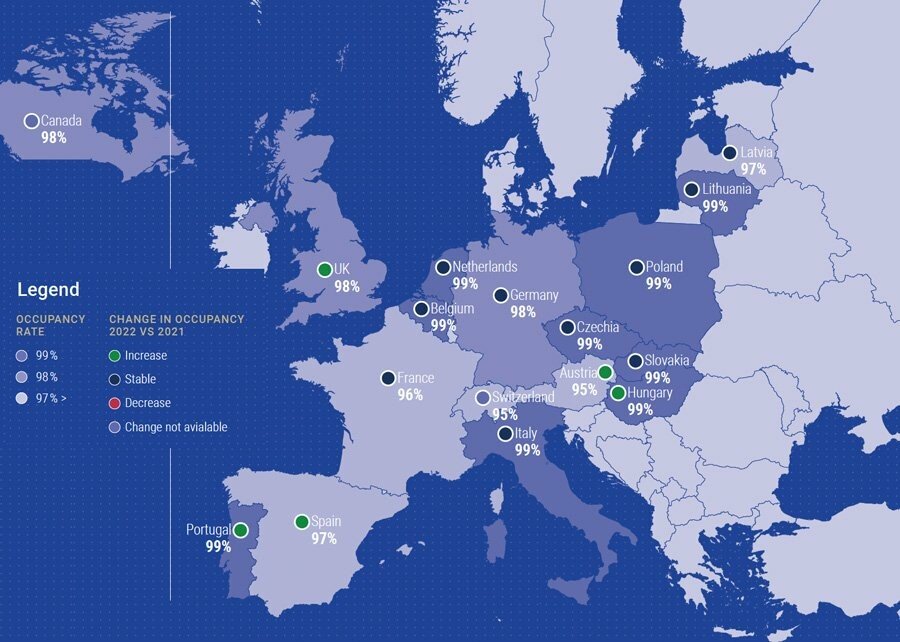

Average occupancy rates in private PBSA housing, 2022. Source: BONARD

Average occupancy rates in private PBSA housing, 2022. Source: BONARD

BONARD adds that, “Overall, occupancy rates across Europe in 2022 averaged 98%, with the lowest value (95%) found in Austria and Switzerland. The asset class remained resilient against inflation as well as the energy crisis, which impacted the operation expenditure levels of most operators to a greater or lesser extent.”