BONARD Blog Series #3: PBSA Amenities & Operation

In our latest edition of the BONARD Blog Series focused on private purpose-built student accommodation (PBSA) market, we look at what differentiates premium from average products in terms of brand with a focus on the UK and continental Europe.

Product composition must take account of local market trends in line with prospective tenants’ needs if further PBSA development is to occur

Amenities offered in Tier 1 cities

Our research showed that, in regard to common areas and facilities in private properties,there are five main difference makers across the major university cities (Tier 1) of Europe and the UK: the presence of gyms (accounting for an almost 20% difference between products), study rooms (15%), TV rooms (20%), games rooms (15%) and terraces (15%). None of these facilities exist in the average rented property marketed at an average price. Turning to the amenities offered by both premium and average products, BONARD identified that laundry rooms (90% share in both), multifunctional rooms (70%), bike storage (60%) and communal kitchens (50%) made the difference.

Amenities offered in Tier 2 cities

The product quality difference is greater in Tier 2 than in Tier 1 cities, where market demand is more driven by competition. In Tier 2 and smaller cities, local developers often work in a different style and with an eye to different client needs to those identified in the more developed markets catered to by Tier 1 providers. Difference makers in smaller cities include gyms (15%), study rooms (15%), communal kitchens (15%) and terraces (20%). Smaller assets generally feature multifunctional rooms encompassing games and cinema facilities in a single space.

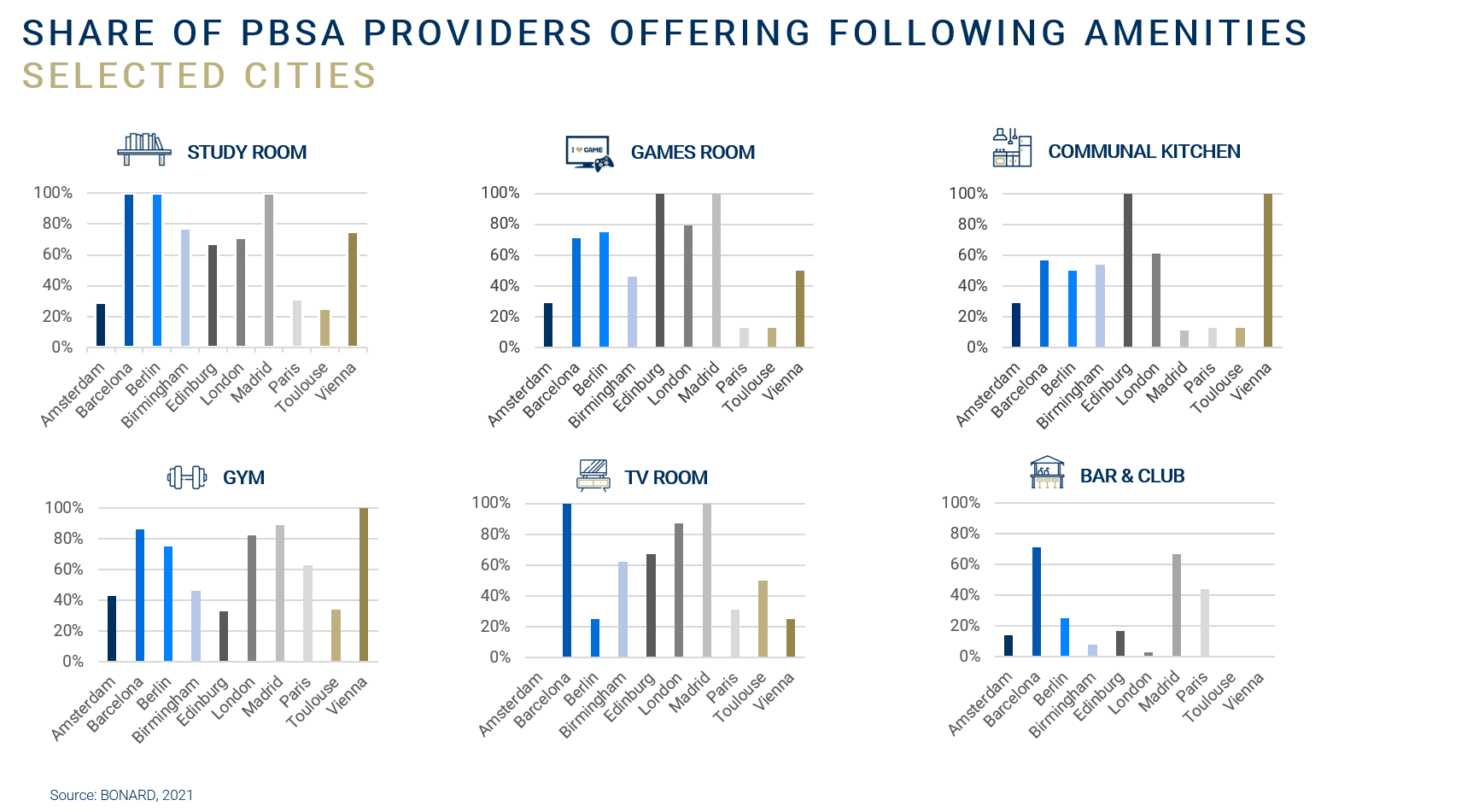

Amenities offered per selected cities

A closer look at the 8,800 PBSA properties and over 200 portfolios monitored by BONARD highlights a comparison of cities and amenities, giving abetter understanding of how these amenities are distributed regionallyand themarket differences between continental Europe and the UK. Thestudy roomis a type of common room which private providers frequently do not offer, in particular in Amsterdam and Paris (30% of providers in both cities) or Toulouse (less than 30%); in Barcelona, Berlin and Madrid, in contrast, it is offered by 100% of providers. French student housing providers do not typically offer agames room(20%), whereas it is a strong part of the product in the UK and Spain (100% of providers offer it in Edinburgh and Madrid).

Communal kitchensappear in 100% of the Edinburgh and Vienna private PBSA but are almost non-existent in Madrid, Paris and Toulouse (10% of providers in each), while the presence of agymis pretty balanced across all cities considered, except for Amsterdam (40% of providers), Edinburgh (30%) and Toulouse (30%).Bars and clubsin a private student residence are a more recent phenomenon; hence, they are more usually present in new/er properties, especially in the Spanish market – Barcelona and Madrid (around 70% of providers in both cities) – and less in other European markets.

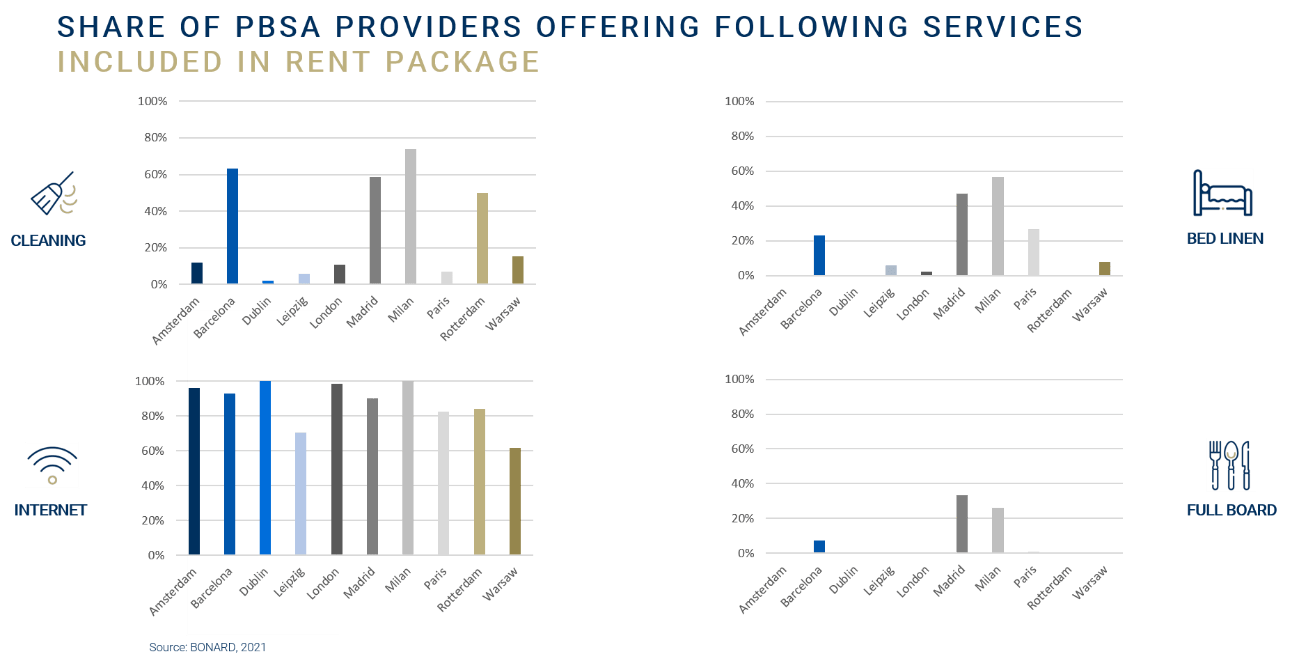

Services included – or not – in the rent

The research also showedwhich services are included in the rent packages of properties across Europeand which are charged as extras. In some cities, such as Milan (70% of properties), Barcelona (over 60%) and Madrid (60%),cleaningis standard. In most cities, however, it is not included in the package.Internetis included in almost all properties. Monthly or more frequentbed linen changeis not usually offered, being restricted to a few cities in Spain (Barcelona – 20% of properties and Madrid – over 40%) and Italy (Milan – almost 60%).Full boardas part of the package is also mostly offered in the Spanish and Italian markets. In fact,the meal plan offer is the most typical difference among PBSA residences across Europe. Private residences in Italy and Spain usually offer meal plans as an obligatory element of the accommodation, which makes the accommodation price higher. In the rest of continental Europe and the UK, non-private and religious establishments typically offer meal plans as an optional service or do not offer them at all.

Quality product is essential

Our research as well as (in-field) market experience indicates thatproduct composition must take account of local market trendsin line with prospective tenants’ needs if further PBSA development is to occur.

With a growing supply, competitiveness will not only be rooted in the rent price, but also in a well-established quality product. This has to be taken into considerationnot only as regards new developments but also assets due for retrofitting.

Methodology Disclaimer: Only aggregated data from privately-funded projects in selected cities were used.

BONARD Research Team:

Patrik Pavlacic

Chief Intelligence Officer

Julia Momotiuk

Rented Residential Director

Lukas Vilimek

Head of Strategic Intelligence