Tertiary education is seen as the passport to a better future for the well-to-do, and especially important for the not so well-off. This should mean that the number of young people seeking to enter university will continue – in both good times and bad.

According to the World Bank, there are around 222m students enrolled in tertiary education globally – up from 100m at the turn of the century.

But a glaring mismatch in available accommodation to house these students exists in all markets. This is particularly acute in the most popular education destinations across the English-speaking world.

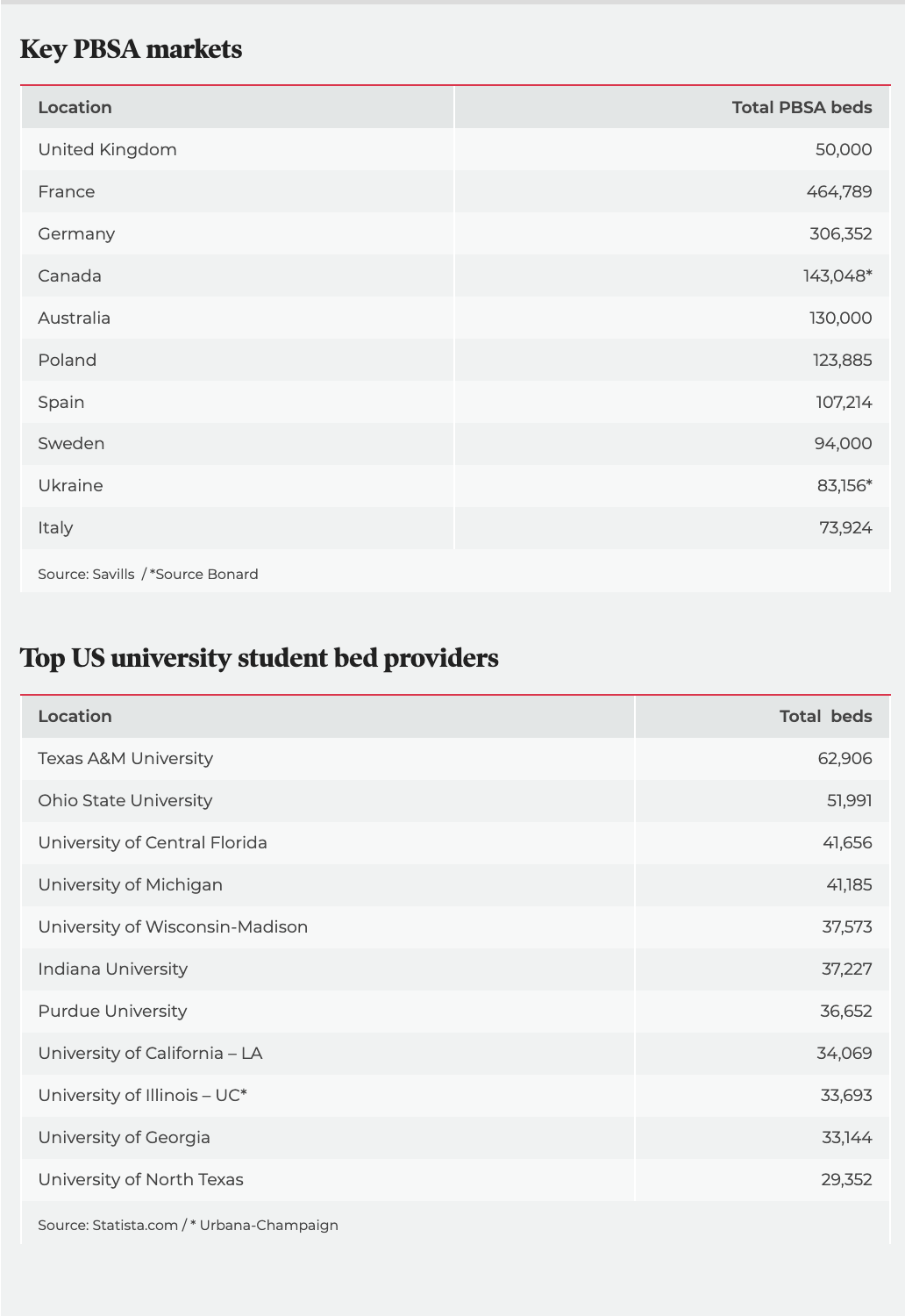

According to US student accommodation specialist SQ Asset Management, now a division of Dubai-based GFH Partners, just 22% of undergraduates of the total enrolment figure of more than 20m at US universities and colleges last year could be housed.

Enrolments are projected to surpass 16m – 15m domestic and 1m foreign students – in 2024-25.

After exceeding US$10bn (€9.7bn) in February 2024, the US student housing market is poised for further expansion in the next five years, says SQ. The National Multifamily Housing Council in the US has projected the number of student beds to increase from 8.45m in 2020 to 9.2m by 2030 – an annual growth rate of a miserly 0.8%.

Raising the provision rate

In a survey of investors, fund managers and operators last year, property adviser Savills and student housing body The Class Foundation found that 70% of respondents expect to increase the size of their European purpose-built student accommodation (PBSA) portfolios over the next two to five years. This equates to an additional 92,500 beds and €22bn in capital. Savills says this will still only raise the European provision rate to 17% from 11% today.

In its UK Student Market Update for the third quarter of 2024, consultancy firm Knight Frank says: “The UK continues to perform well in a global context, accounting for 46% of total global capital flows into PBSA worldwide so far this year. This reinforces the attractiveness of the asset class and investor appetite. In the UK, overseas investors accounted for 22% of UK deals in 2021, 41% in 2022 and 46% in 2023.”

Nearly £840m (€1bn) was invested in the UK PBSA market in the third quarter of 2024 involving 15 deals. Knight Frank says volumes were “comfortably” above the 10-year average for this quarter, taking total investment over the first nine months of 2024 to £3.3bn – considerably more than the £2bn spent at the same point a year earlier.

In its Australian Student Accommodation 2024 report, published in December, Savills says significant new capital allocations will need to find a home over 2025. As such, some markets are expected to see yield compression over the next 12 months, although they will need more competitive bidding pressure given that risk premiums remain tight.

Currently, a large portfolio operating as Campus Living Villages (CLV), owned by four Australian superannuation funds, is on the market. The owners are testing the strength of demand for this asset class. When first offered for sale in 2016, the asking price was A$2bn (€1.2bn). CLV owns 27,000 beds in Australia, the US and the UK. It is seeking bids for 100% or parts of the business.

Australia’s leading office landlord, Dexus, is believed to be at the forefront of bidders, having submitted its second offer for CLV’s Australian assets. Dexus inherited student housing from its takeover of an AMP Capital social infrastructure fund, which owns 7,000 beds. Other reported suitors for the CLV portfolio include Melbourne-based Plenary Group, Dutch pension manager PGGM, and Singapore’s Mapletree and Greystar.

Source: Statista.com / * Urbana-Champaign

The global record for student housing transactions was set in 2022 when Blackstone paid US$13bn to take American Campus Communities private, making it the last pure student housing public REIT to be delisted. Two other REITs are now privately owned. Harrison Street took over Campus Crest Communities in 2015, and Greystar acquired EdR in 2018.

The Blackstone deal was responsible for pushing total transactions in 2022 to an all-time high. The US market alone handled US$14.48bn in portfolio sales, and including individual sales, the total was US$22.8bn, according to MSCI Real Estate and CoStar.

Asset sales dry up

Since this high point, however, sales of student housing assets have dried up. There are many reasons, not least the number of available portfolios for sale.

The handful of notable transactions in 2024, with a couple yet to be finalised, totalled just US$4.4bn. Buyers included two Singapore companies – Mapletree and Cuscaden Peak Investments – which transacted on a portfolio of 33,000 beds for £1bn. Late last year, another Singapore company, Wee Hur, and its backer GIC offloaded an Australian portfolio for A$1.6bn. Scion Group bought 14 US properties located close to leading universities from Harrison Street for US$893m. On behalf of TIAA, Nuveen Real Estate and UK-based Dot Group paid €540m for a portfolio held by French real estate group, Gecina.

At the close of the year, Dubai-based GFH Partners bought a portfolio located near 13 popular US universities for US$300m. The acquisition has boosted GFH Partners’s US student housing platform to more than 5,500 beds, with assets under management worth about US$900m.

GFH also bought a majority stake in SQ Asset Management, which currently has US$1.3bn in assets under management (34 student housing facilities with more than 12,500 beds).

“With robust fundamentals in place, numerous owners are opting to maximise leasing activity andn revenue growth by retaining ownership of their assets instead of selling”

SQ Asset Management

At the time of the acquisition, Nael Mustafa, CEO of GFH Partners, said: “We continue to see merit in deploying capital in this sector due to demand-supply imbalances in leading, four-year public universities with strong research and/or sporting programmes.”

Industry leaders estimate that sales fell 70% last year compared with the bumper number of transactions in 2022. The lack of assets available makes existing investors think twice before selling.

“With robust fundamentals in place, numerous owners are opting to maximise leasing activity and revenue growth by retaining ownership of their assets instead of selling,” says SQ Asset Management. “This decision has led to a decrease in the number of property sales.”

Others go further. Investors in a closed-ended fund managed by Scape Australia, the country’s largest PBSA developer/owner/operator, initiated a move to convert the fund into an evergreen open-ended vehicle. They were happy to lock their investment into a A$6bn portfolio indefinitely (see separate report in this section).

The decision taken by Scape Australia’s investors underscores the shortage of good assets available for investment.

PBSA is not easily produced. It have to be developed in the right locations and sites have to be available. It is a problem facing many operators in major cities around the world.

Rather than hunt for greenfield sites, PBSA players are increasingly exploring alternative avenues such as repurposing existing projects and transforming older accommodation into new opportunities to address growing demand.

⠀

Source: Statista.com / * Urbana-Champaign

Source: Statista.com / * Urbana-Champaign