Investors and lenders alike expect university life to return quickly post-pandemic, reports Nicol Dynes.

The impact of the coronavirus pandemic on the student housing sector will be short-lived, according to experts, who point to last year’s investment volumes in Europe, which reached €9 billion – a very strong result given national lockdowns and travel restrictions.

“Covid-19 is a blip in the progress of PBSA across the world, while it has exacerbated challenges in other sectors,” says Will Rowson, CEO of Global Student Accommodation. “Most investors can see beyond the temporary drops in income to the long-term growth ahead, which is why we are seeing a broader range of investor demand than in the past, including high-net-worth individuals.”

The relative performance of the student housing sector has been robust, while micro-living and co-living have been more adversely affected.

“There is strong investor demand and most institutions are still underweight, they want to increase their exposure to the sector,” says Stephen Miles, head of operational real estate investment, Continental Europe, at CBRE. “We’ve seen compression on yields in the last few months. My advice is be diligent in your underwriting and be careful about price points.”

“Investors know there is a tailwind that will push the sector forward over the long term,” adds Mark Holz, head of research at Corestate Capital Partners.

Banks onside

The sector’s strong fundamentals are the reason why even the most cautious of banks have continued their support during last year’s turmoil. “Banks see it as a short-term blip and are taking a sensible view on debt,” says Brian Welsh, head of student at Round Hill Capital. “Student housing is seen as benign asset class by lenders, who have much bigger problems on their books at the moment.”

No covenants are being broken in the sector, while hotels, for example, are facing two consecutive summers of no revenue. In difficult times lenders flock to quality and will still support a good business plan with bright prospects.

“A lot of transactions are development and forward-funding, which jumps over the problem because it takes you past the pandemic scenario,” says Miles. “The forward-funding market has been really interesting. Of course there are underwriting challenges, some systemic and some due to the coronavirus bump in the road, but I’m pretty optimistic on the sector’s future.”

September 2021 could signal the return to normality in the European student housing sector. “Everyone has experienced some disruption due to the pandemic,” says Welsh. “But we expect the domestic student market to go back to normal in the autumn term this year, in Covid-secure residences. For international students it will depend on flight restrictions being lifted, because you can’t get the bus from China. But by September 2022 it will all be in the rear view mirror.”

In the short term, the composition of tenants in PBSA will change, as domestic students and students from other European countries replace overseas arrivals, but demand will pick up. “Occupancy rates will go up again, because young people are desperate to get back to university,” says Rainer Nonnengässer, CEO of International Campus.

“My expectation is that we’ll see a stronger inflow of students from Spain and Italy, eager to get away from their less vibrant economies. We saw that trend after the GFC and we’ll see a similar phenomenon this year, but by 2022 at the latest we’ll be back to normal.”

The UK, which is more reliant on international students, may experience more difficulties and its exit from the Erasmus mobility scheme will benefit countries like Ireland and the Netherlands.

A renaissance ahead

Germany offers a lot to students and investors alike, says Holz: “Universities are excellent and good value for money, while the polycentric nature of the country makes an interesting investment proposition, because you can have a diversified strategy within one country.”

Ireland and the Netherlands have the advantage of English language courses, while Germany offers large cities like Berlin and also smaller university towns such as Heidelberg.

But other countries are fast emerging. “It is naive to think that Western Europe will hold a monopoly over higher education for long,” says Welsh. “Poland is a sleeping giant, and the cost of becoming a doctor there is 10% of becoming one in the US. Portugal is flexible and willing to have more courses in English.”

Universities across Europe are ambitious and want to expand, so the offer is becoming more varied and students have more choices. “The digital nomads have not disappeared with coronavirus: students and young people will go back to being mobile and dynamic, choosing where to live and work,” says Holz. “I am optimistic that after the pandemic we’ll witness a renaissance.”

Investor sentiment towards sector remains strong

Investors are looking beyond the pandemic and are ready to deploy more capital into student accommodation.

The sector proved its resilience last year during the pandemic – 79% of PBSA under construction was delivered on time in 2020, with only 21% delayed and often for reasons not linked to Covid-19.

The market also performed better than expected: occupancy levels were down to between 85% and 95% in Germany, Benelux and CEE and down to 60% in Italy and Spain.

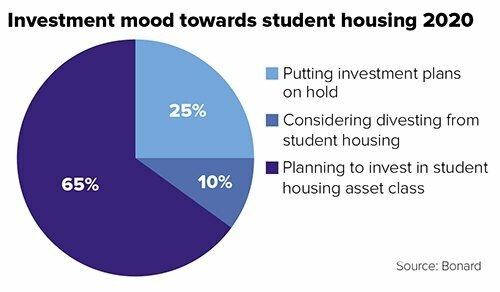

“The investment mood is positive. According to the latest survey, 65% of investors plan to buy more in the sector, 25% have put their plans on hold because of the situation and only 10% are thinking of divesting. Zero per cent needed refinancing,” says Stefan Kolibar, head of marketing, communication & PR at student housing specialist Bonard.

“Student accommodation adapted and became safe houses during the pandemic,” adds Kolibar. “The Erasmus programme was also a big factor, as the 300,000 students enrolled are required to be physically present in their study destinations, even if the teaching is online, or they lose their funding.”

The biggest factor, however, is “the fact that students see their PBSA as their home and they prefer to be there”, he adds.

The transactions market also performed better than expected, with 74 deals completed in 2020 against 89 the previous year. The total transaction value was almost unchanged in Continental Europe: €2.54 billion in 2020 versus €2.55 billion in 2019.

Total transaction value in the UK was higher, rising from €5.2 billion in 2019 to €6.4 billion last year, but these figures were skewed by one massive deal – Blackstone’s acquisition of IQ Student Accommodation for £4.7 billion.

Transactions tended to be bigger in Europe, with an average value of €85 million and average size of 324 beds, compared with the UK, where average value was €31 million with 286 beds.

Looking at the pipeline, €14 billion has been invested in new PBSA and 7,000 new beds will be added in the next two and a half years in Europe.

The expectation is that things will return to normal in the autumn term 2021 and operators appear to be confident about occupancy levels between now and then.

“The majority (56%) are not planning any additional actions to attract students, while 20% are offering rent reductions for a limited time for students who genuinely cannot travel, 16% are offering free cancellation and flexible start dates and only 8% are giving Covid booking guarantees, meaning that you don’t pay if you don’t move in,” says Kolibar.