Transactional Advisory

Our Transactional Advisory services support investors in making informed decisions and maximizing value through comprehensive analysis and strategic optimization of student housing assets and portfolios.

PRODUCT DESCRIPTION

What is Transactional Advisory?

Our Transactional Advisory services support investors at every stage of the investment lifecycle by combining in-depth analysis with strategic guidance. We offer detailed evaluations of market fundamentals, asset performance, and future projections through Single-Asset or Portfolio Underwriting to facilitate informed investment decisions.

Additionally, our Single-Asset or Portfolio Optimization focuses on enhancing the operational, financial, and strategic aspects of assets and portfolios, unlocking value, improving performance, and ensuring alignment with market standards. Whether assessing a new investment or optimizing an existing one, our expertise ensures maximum value and clarity in decision-making.

TAILORED FOR ALL INVESTORS, ESPECIALLY CORE/CORE+ LPs

Single-asset or Portfolio Underwriting

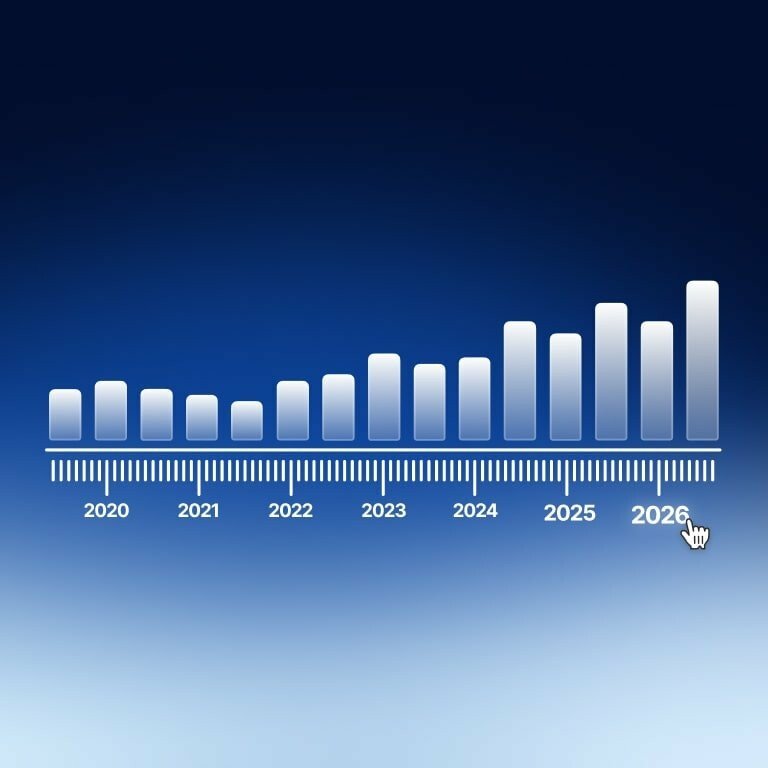

We provide detailed underwriting support for student housing investments, combining macro and micro-level market analysis. This includes in-depth assessments of demand (student demographics and mobility), supply (bed counts, establishment types, and pipeline data), rental dynamics, and market provision rates. Our forecasting tools predict future trends in demand, supply, market saturation, and rent growth. We also benchmark single-asset or portfolio performance, evaluating OPEX/CAPEX structures, NOI margins, and financial outcomes against local and global standards, ensuring a robust foundation for investment decisions.

TAILORED FOR ALL INVESTORS, ESPECIALLY THOSE SEEKING VALUE-ADD AND STRATEGIC GROWTH

Single-asset or Portfolio Optimization

A detailed review of asset operation data, combined with an in-person site visit, mystery shopping, and interviews with the property manager, to identify potential risks, operational efficiencies, and opportunities to unlock additional value for each asset.

DELIVERY DESCRIPTION

What are you getting?

The advisory is tailored to specific business needs and can include, but is not limited to, the following:

CONTACT FORM

Find out how we can help your business grow

If you are interested in learning more about how our transactional advisory helped particular clients, please fill out the contact form to get in touch.

RELATED PRODUCTS